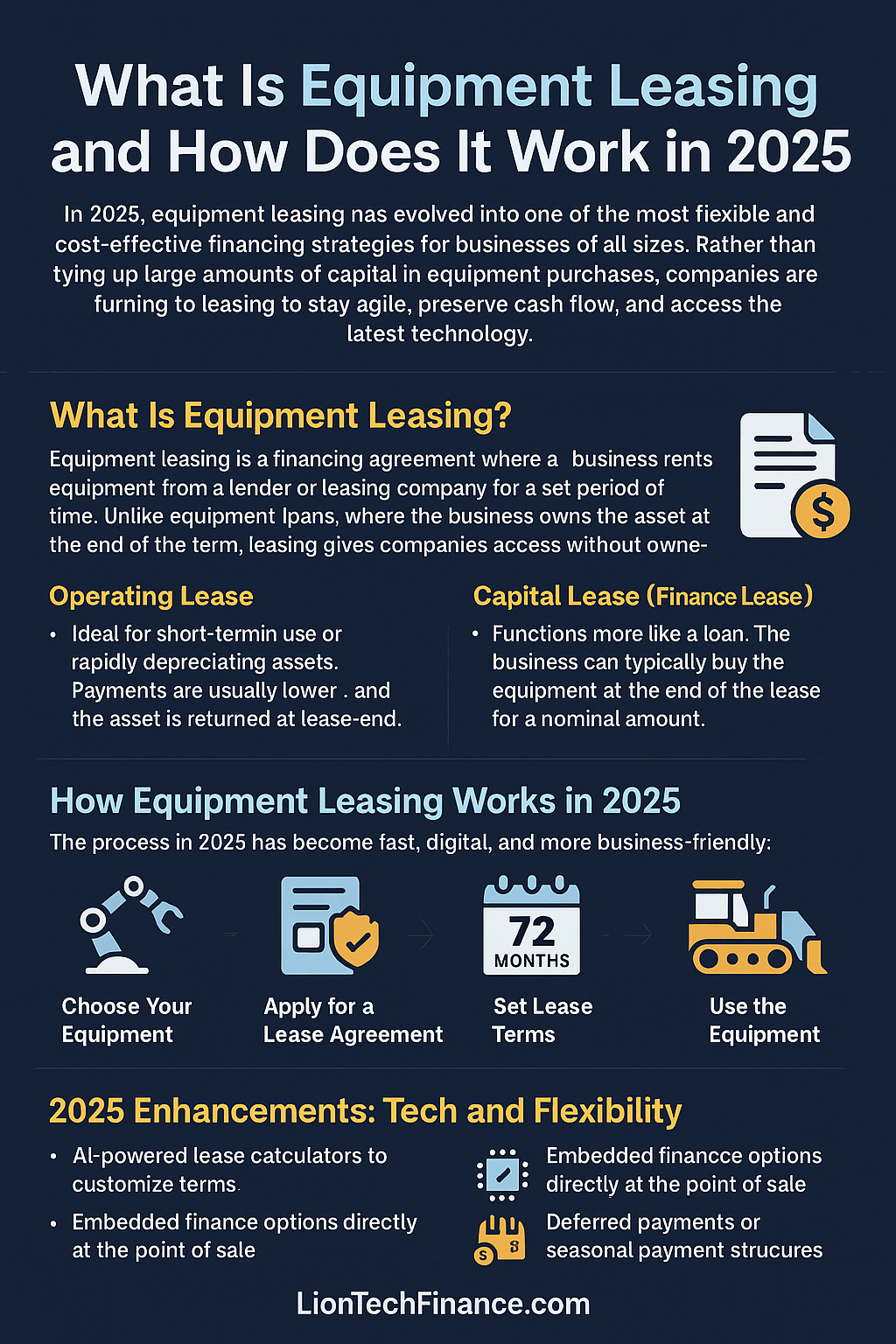

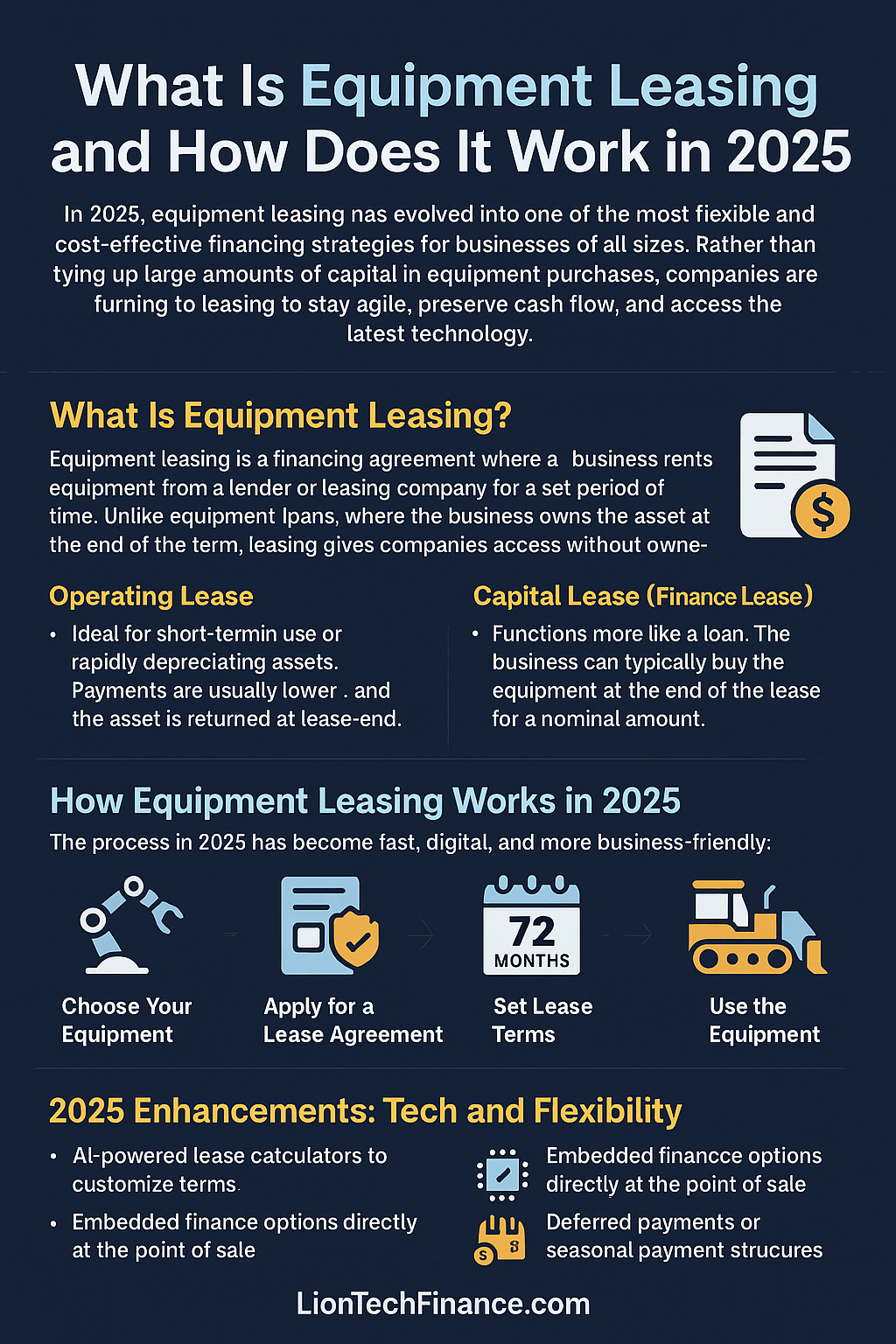

What Is Equipment Leasing and How Does It Work in 2025?

In 2025, equipment leasing has evolved into one of the most flexible and cost-effective financing strategies for businesses of all sizes. Rather than tying up large amounts of capital in equipment purchases, companies are turning to leasing to stay agile, preserve cash flow, and access the latest technology.

What Is Equipment Leasing?

Equipment leasing is a financing agreement where a business rents equipment from a lender or leasing company for a set period of time. Unlike equipment loans, where the business owns the asset at the end of the term, leasing gives companies access without ownership.

There are two primary types of equipment leases in 2025:

Operating Lease – Ideal for short-term use or rapidly depreciating assets. Payments are usually lower, and the asset is returned at lease-end.

Capital Lease (Finance Lease) – Functions more like a loan. The business can typically buy the equipment at the end of the lease for a nominal amount.

How Equipment Leasing Works in 2025

The process in 2025 has become fast, digital, and more business-friendly:

Choose Your Equipment – Businesses can lease anything from manufacturing machines to IT hardware, commercial vehicles, or medical equipment.

Apply for a Lease Agreement – Most leasing companies offer streamlined online applications with fast approvals.

Set Lease Terms – Choose lease length (usually 12–72 months), monthly payment amounts, and end-of-term options (return, renew, or buy).

Use the Equipment – Once approved, your business can start using the equipment right away without a large upfront cost.

2025 Enhancements: Tech and Flexibility

Leasing in 2025 now includes:

AI-powered lease calculators to customize terms

Embedded finance options directly at the point of sale

Deferred payments or seasonal payment structures

Bundled maintenance and upgrade options

Equipment Loans vs. Equipment Leasing: Key Differences Explained

Choosing between an equipment loan and an equipment lease in 2025 can significantly impact your business’s cash flow, tax strategy, and operational flexibility. Understanding the key differences helps decision-makers align financing with growth goals and budget priorities.

What Is an Equipment Loan?

An equipment loan is a financing solution where your business borrows money to purchase equipment outright. You make monthly payments, usually with interest, until the loan is paid off and the equipment is fully owned.

Ownership: Your business owns the equipment from day one.

Down Payment: Usually requires 10–20% upfront.

Depreciation: You can claim depreciation and interest as tax deductions.

What Is Equipment Leasing?

With equipment leasing, you rent the equipment from a leasing provider for a fixed term. At the end of the lease, you may return it, renew the lease, or buy the equipment (depending on the lease type).

No Ownership: You don’t own the equipment unless you choose to buy it at the end.

Lower Upfront Costs: Usually little to no down payment required.

Tax Benefits: Lease payments may be fully deductible as operating expenses.

Side-by-Side Comparison: Leasing vs. Loans

| Feature | Equipment Loan | Equipment Lease |

|---|---|---|

| Ownership | You own it | You rent it |

| Upfront Cost | 10–20% down payment | Low or no upfront cost |

| Flexibility | Less flexible | Highly flexible terms |

| End-of-Term Options | You keep the equipment | Return, renew, or buy |

| Balance Sheet Impact | Asset appears as a liability | May qualify as off-balance-sheet item |

| Best For | Long-term use, stable equipment needs | Short-term use, fast-changing tech |

Which Is Right for Your Business in 2025?

Choose a loan if your business values ownership and plans to use the equipment long term.

Choose a lease if you want lower upfront costs, more flexibility, or to upgrade your equipment.

Why More Small Businesses Are Choosing Equipment Leasing in 2025

In 2025, small businesses are under increasing pressure to stay lean, agile, and competitive. Traditional loans often come with rigid terms, large upfront costs, and long approval timelines. That’s why a growing number of small businesses are choosing equipment leasing to finance essential tools and technology.

Leasing Reduces Upfront Financial Pressure

Small businesses often face cash flow constraints, especially when scaling or launching new projects. Equipment leasing helps by eliminating the need for large upfront investments.

No down payment or minimal upfront cost

Predictable monthly payments

Preserves working capital for growth, payroll, and operations

Faster Access to Equipment

Unlike loans that can take weeks for approval and disbursement, leasing in 2025 is digital, fast, and streamlined.

Online applications with same-day approvals

Pre-approved lease programs through vendors

Quicker delivery and implementation of essential equipment

Flexibility Is a Major Advantage

Small businesses value the ability to pivot. Leasing provides that flexibility:

Shorter contract terms

Option to return, renew, or upgrade

Easy scaling as business needs change

Staying Competitive With Up-to-Date Tech

In fast-moving industries, outdated equipment can be a disadvantage. Leasing gives small businesses access to cutting-edge tools without the burden of ownership.

Easy equipment upgrades at lease-end

Stay ahead with the latest features and compliance standards

Avoid obsolescence risk

Leasing Helps Small Businesses Qualify

Many small businesses struggle to qualify for traditional loans due to limited credit history or inconsistent revenue. Leasing companies in 2025 often have more flexible underwriting criteria.

Credit-friendly options available

Startup-friendly lease programs

Vendor-supported leasing plans

In 2025, construction companies are increasingly turning to leasing as a smarter alternative to buying heavy equipment. With fluctuating demand, rising equipment costs, and the need for up-to-date machinery, leasing provides the agility and financial control that contractors and builders need to stay competitive.

1. Lower Upfront Costs

Buying construction equipment requires a significant upfront capital investment. Leasing, on the other hand, usually comes with little or no down payment, freeing up funds for payroll, project expansion, or marketing.

Avoid large capital expenditures

Spread payments across the lease term

Get access to premium equipment without upfront financial strain

2. Preserve Cash Flow

Leasing offers predictable monthly payments, which are easier to manage compared to lump-sum purchases or variable loan repayments. This helps construction firms maintain strong cash flow — critical for managing labor, supplies, and unexpected costs on job sites.

3. Flexibility to Upgrade Equipment

Construction equipment evolves fast. Leasing allows companies to upgrade to newer models at the end of the lease, keeping operations efficient and avoiding costly repairs on outdated machines.

Stay current with safety standards and emissions compliance

Choose shorter leases for fast-evolving equipment categories

Replace underperforming machines without financial loss

4. Reduced Maintenance and Downtime

Many lease agreements include maintenance packages, reducing unexpected costs, and keeping equipment running smoothly.

Less responsibility for long-term wear and tear

Quicker replacement if something breaks down

Focus on projects, not repairs

5. Tax Advantages for Construction Firms

In most cases, lease payments can be written off as business expenses, which may offer more favorable deductions than depreciation on purchased equipment. Always check with a tax advisor, but this is a key reason construction CFOs lean toward leasing.

Tax Advantages of Leasing Equipment for Businesses in 2025

In 2025, businesses will continue to leverage equipment leasing not only for cash flow and flexibility but also for significant tax benefits. The tax code remains favorable to leasing strategies, making it a powerful tool for businesses looking to reduce taxable income and improve financial efficiency.

Section 179 Deduction

Many leases qualify for Section 179, allowing businesses to deduct the full cost of leased equipment (up to the annual limit) as if it were purchased outright, even though no large upfront payment was made. This provides a major incentive to lease while preserving capital.

Off-Balance Sheet Benefits

Operating leases, in particular, may qualify for off-balance sheet treatment, which can improve key financial ratios and make a company appear more attractive to lenders and investors.

Predictable Deductions

Lease payments are typically fully deductible as a business expense, offering predictable, recurring write-offs that simplify financial planning.

No Depreciation Headaches

Since the leasing company retains ownership of the equipment, the lessee avoids managing depreciation schedules, making tax filing cleaner and less burdensome.

Custom Structuring for Maximum Benefit

Many leasing companies offer customized terms to align with a business’s fiscal year, revenue cycle, or tax strategy, giving added control over when and how deductions are claimed.

In short, leasing offers businesses in 2025 not only operational and financial flexibility but also a smart tax strategy that supports growth.

2025 Equipment Financing Trends: What CFOs Should Know

In 2025, equipment financing has become more than a tactical choice; it’s a strategic lever for financial leaders navigating a volatile economy. With rising rates, stricter lending, and accelerated tech adoption, CFOs need to stay ahead of key shifts that impact capital planning and operational agility.

Leasing Is Outpacing Purchasing

With cash preservation a top priority, more businesses are turning to leasing over outright purchases. Leasing allows companies to access necessary equipment without large upfront costs, offering flexibility to upgrade or pivot as needs evolve.

Custom Structures Are Now the Norm

Gone are the days of one-size-fits-all terms. CFOs are demanding flexible options, deferred payments, seasonal schedules, and step-up terms to better match cash flow and project cycles. Lenders that offer customized deal structures are gaining a competitive edge.

Working Capital Is Being Reprioritized

With tighter credit and cautious investors, maintaining liquidity is essential. Equipment financing allows companies to preserve working capital for core operations, unexpected costs, or growth initiatives.

Sustainability Is Driving Equipment Decisions

CFOs are factoring in ESG goals when choosing equipment. Leasing allows businesses to upgrade to newer, more energy-efficient models without locking themselves into outdated technology.

Smart Equipment Needs Smart Financing

Automation, AI, and IoT-enabled machinery come with high upfront costs but are essential for modern operations. Financing spreads out the investment while keeping productivity high and technology current.

Underwriting Standards Are Tightening

Lenders in 2025 are conducting more thorough credit evaluations. CFOs should be prepared with detailed financials, strong projections, and a clear business case to secure the best terms.

When Does It Make Sense to Buy Equipment Instead of Lease?

While equipment leasing offers flexibility and lower upfront costs, there are situations where purchasing equipment outright is the smarter financial move. Understanding when to buy rather than lease can help businesses avoid unnecessary financing costs and gain long-term asset value.

Buying Equipment Makes Sense for Long-Term, High-Use Assets

If your business relies on equipment that will be used daily for five or more years, such as heavy machinery, manufacturing systems, or core technology infrastructure, buying can be more cost-effective over time. The longer the asset’s useful life, the more value you extract from owning it.

Tax Depreciation and Asset Ownership Benefits

When you purchase equipment, you can take advantage of depreciation over multiple tax years, potentially resulting in a larger long-term deduction than leasing. Ownership also adds to your balance sheet, increasing asset value and potential resale gains.

When Equipment Doesn’t Obsolete Quickly

For industries with slow tech turnover, such as construction, agriculture, or industrial transport, buying is often smarter than leasing. If you won’t need to upgrade every few years, a purchase locks in value and avoids recurring financing expenses.

How to Choose the Right Equipment Financing Option for Your Industry

Each industry has unique cash flow cycles, risk factors, and operational needs, which makes choosing the right equipment financing strategy critical. Whether you’re in healthcare, construction, or manufacturing, your financing should align with how your business operates.

Construction Equipment Financing Needs Flexible, Seasonal Terms

Construction companies often face project-based income and downtime during off-seasons. A financing solution with deferred payments or seasonal structures ensures you aren’t paying during low-revenue periods.

Healthcare Providers Need Low-Risk, Technology-Ready Leasing

In the healthcare industry, equipment becomes obsolete quickly. Leasing enables hospitals and clinics to access advanced imaging machines or diagnostic tools without the financial burden of outdated tech or resale headaches.

Manufacturers Should Consider Capital Leases for Core Machinery

For manufacturers relying on durable, long-term equipment like CNC machines or assembly lines, capital leases that convert to ownership after the term can provide the best mix of tax benefits and financial stability.

Impact of Interest Rates on Equipment Loans vs. Leases in 2025

As of 2025, elevated interest rates are influencing how businesses approach equipment financing. The rate environment directly affects monthly payments, total cost of ownership, and even loan approval odds, making the choice between leasing and loans more strategic than ever.

Equipment Loans Are Heavily Impacted by Rising Interest Rates

Traditional equipment loans are directly tied to interest rates. As rates climb, so do monthly payments and total financing costs. For rate-sensitive industries, leasing can provide a hedge against loan volatility.

Fixed-Rate Equipment Leasing Offers Predictability

Most lease agreements in 2025 are structured with fixed monthly payments, which are not tied to fluctuations in interest rates. This makes leasing a safer option for businesses needing budget stability and cash flow consistency.

Credit Requirements Tighten as Rates Climb

Higher interest rates lead to tighter lending standards. Businesses with less-than-perfect credit may find leasing more accessible than traditional loans, especially when lenders raise the bar for approvals.

Leasing vs. Loans: Real-World Case Studies from Growing Businesses

Understanding how real companies make financing decisions offers practical insight into the lease vs. loan debate. Below are a few case studies that illustrate how different businesses leveraged financing to support growth.

Case Study: Leasing Medical Equipment to Scale Faster

A growing outpatient imaging center needed multiple MRI and CT machines but wanted to avoid large upfront costs. By leasing through a flexible vendor program, they added 3 units in under 90 days, accelerating growth without draining capital.

Case Study: Purchasing Construction Equipment for Long-Term ROI

A mid-size general contractor opted to buy a $400K crane using a 5-year equipment loan. Since the crane was core to daily operations and had a 15+ year useful life, the purchase delivered strong ROI, with ownership kicking in well before major depreciation.

Case Study: Hybrid Financing for a Food Production Startup

A packaged food company leased packaging machinery and financed its conveyor system through a loan. This hybrid approach allowed them to keep payments low while retaining ownership of high-value, long-term assets.