Why Cash Flow Management is Critical in 2025

For many CFOs, controllers, and business owners, managing cash flow effectively remains one of the most persistent challenges. Cash flow is the lifeblood of any business, and without it, even the most innovative companies can falter. The consequences of poor cash flow management are far-reaching: missed opportunities for growth, operational disruptions, and heightened stress during times of economic uncertainty.

The Impact of Economic Shifts on Cash Flow

In today’s volatile economy, businesses face rising interest rates, fluctuating demand, and supply chain challenges. These factors amplify the need for a proactive approach to managing working capital. Failing to address these challenges can leave businesses vulnerable to financial instability and make it difficult to capitalize on opportunities that arise.

How Tailored Working Capital Solutions Can Transform Your Business

But it doesn’t have to be this way. With tailored working capital solutions, businesses can unlock new growth opportunities, stabilize their finances, and thrive in the face of economic changes. These solutions aren’t one-size-fits-all; they are customized to address your specific needs, ensuring that your company remains competitive in 2025’s rapidly evolving business landscape.

Benefits of Strategic Working Capital Management

- Unlock Growth Opportunities: Gain access to the resources you need to expand into new markets or invest in innovative technologies.

- Enhance Financial Stability: Minimize the risks associated with cash flow shortfalls by maintaining a healthy balance between income and expenses.

- Stay Competitive: With optimized cash flow, your business can respond quickly to market changes and seize opportunities ahead of competitors.

What This Guide Covers

This guide will explore how working capital solutions can help you achieve your financial goals. From understanding the fundamentals of cash flow management to implementing strategies for success, you’ll discover actionable insights to strengthen your business’s financial health.

The Basics of Cash Flow Management

Learn why cash flow is critical and the common pitfalls to avoid.Top Working Capital Solutions for 2025

Discover the best tools and strategies to optimize your finances.Real-Life Success Stories

See how businesses like yours have transformed their cash flow with the right solutions.- The Role of Technology in Cash Flow Optimization

Discover how AI and automation are transforming financial management and helping businesses stay ahead.

Get ready to take control of your finances, reduce stress, and position your business for sustainable success in 2025.

The Basics of Cash Flow Management

Effective cash flow management is the cornerstone of financial health for any business. It ensures that your company has the liquidity to cover its expenses, invest in growth, and weather economic uncertainties. Yet, many businesses struggle to maintain a healthy cash flow, often falling into traps that can jeopardize their operations.

What Is Cash Flow and Why Is It Critical?

At its core, cash flow refers to the movement of money into and out of your business. It’s more than just numbers on a spreadsheet—it’s the financial pulse of your organization. Positive cash flow means you have more money coming in than going out, which allows you to:

- Cover Operational Costs: Ensure you can pay employees, suppliers, and utilities without interruptions.

- Invest in Growth: Allocate resources to new products, markets, or technologies.

- Build a Financial Cushion: Protect your business from unexpected expenses or downturns.

On the other hand, poor cash flow management can lead to missed opportunities, strained vendor relationships, and even insolvency.

Common Pitfalls in Cash Flow Management

Avoiding cash flow pitfalls is just as important as maintaining it. Here are some of the most common mistakes businesses make and how you can sidestep them:

1. Overestimating Revenue Projections

Many businesses overestimate their future income, leading to overspending based on anticipated revenue that doesn’t materialize. Instead, use conservative estimates and historical data to guide financial planning.

2. Neglecting to Monitor Cash Flow Regularly

Failing to track cash flow frequently can leave you blindsided by shortfalls. Establish a system to monitor your cash flow weekly or even daily to stay ahead of potential issues.

3. Excessive Inventory Spending

Holding too much inventory ties up valuable cash. Implement just-in-time inventory systems or conduct regular audits to optimize stock levels.

4. Ignoring Payment Terms

Not negotiating favorable payment terms with suppliers or failing to enforce customer payment deadlines can disrupt your cash flow. Balance incoming and outgoing payments to maintain liquidity.

5. Relying Too Heavily on Debt

While loans can be a lifeline, excessive reliance on debt without a repayment plan can lead to financial instability. Use debt strategically and ensure it aligns with your cash flow projections.

How to Avoid These Pitfalls: Best Practices

Conduct Regular Cash Flow Analysis

Analyze your cash flow statements to identify patterns and forecast future needs. Tools like cash flow forecasting software can provide insights into potential shortfalls and surpluses.

Create a Cash Reserve

Building a financial buffer can safeguard your business during downturns. Aim to set aside at least three months of operating expenses.

Optimize Payment Schedules

Encourage early payments from clients with discounts and negotiate extended terms with vendors. This balance can keep your cash flow positive.

Invest in Automation Tools

Leverage financial software to automate invoicing, track receivables, and generate real-time cash flow reports. These tools save time and reduce errors, improving overall cash flow management.

Why Understanding Cash Flow Is the First Step to Success

Mastering cash flow management isn’t just about avoiding financial missteps; it’s about positioning your business for sustainable growth. When you understand your cash flow, you can make informed decisions that drive profitability, secure financing with confidence, and capitalize on opportunities as they arise.

By recognizing the importance of cash flow and avoiding common pitfalls, you set a strong foundation for your business to thrive in 2025 and beyond.

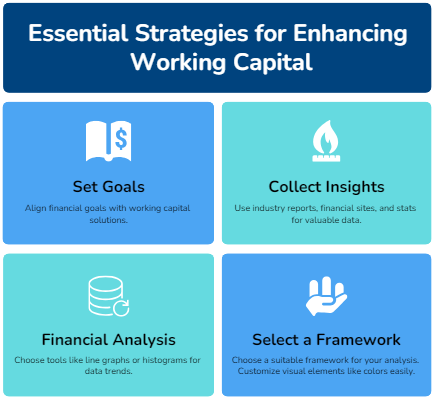

Top Working Capital Solutions for 2025

In 2025, effective working capital management is no longer optional—it’s essential for businesses to stay competitive and resilient in a fast-evolving economic landscape. The right working capital solutions can optimize your cash flow, reduce financial stress, and empower your business to seize growth opportunities.

This guide explores the top tools and strategies that CFOs, controllers, and business owners need to know to optimize their finances.

Why Working Capital Solutions Are Essential for Business Growth

Working capital is the lifeblood of your business operations. It’s the difference between your current assets (cash, accounts receivable, inventory) and current liabilities (accounts payable, short-term debt). A healthy working capital position ensures your business can:

- Maintain Smooth Operations: Cover day-to-day expenses like salaries, rent, and utilities without delays.

- Fund Growth Initiatives: Allocate resources to expansion projects or technology upgrades.

- Navigate Economic Uncertainty: Build a financial buffer to withstand market fluctuations or unforeseen challenges.

The right working capital solutions provide flexibility, allowing your business to adapt and thrive, regardless of external conditions.

Best Tools and Strategies for Optimizing Working Capital in 2025

1. Invoice Financing: Unlock Cash Tied in Receivables

Waiting for customers to pay their invoices can create cash flow gaps. Invoice financing allows you to access a portion of your accounts receivable upfront, providing immediate liquidity to fund operations or investments.

Key Benefits:

- Quick access to cash without taking on traditional debt.

- Improved cash flow predictability.

2. Business Line of Credit: Flexible Access to Funds

A business line of credit acts as a safety net for unexpected expenses or short-term cash flow needs. Unlike a traditional loan, you only pay interest on the amount you use.

Key Benefits:

- Flexible borrowing with revolving credit.

- Ideal for seasonal businesses or managing unexpected costs.

3. Dynamic Discounting: Optimize Supplier Payments

Dynamic discounting enables businesses to negotiate discounts with suppliers for early payments. This not only improves supplier relationships but also enhances cash flow management by creating savings on expenses.

Key Benefits:

- Reduce procurement costs.

- Strengthen supplier partnerships.

4. Inventory Management Solutions: Free Up Capital

Excess inventory ties up valuable working capital. Investing in inventory management tools helps businesses optimize stock levels, reduce waste, and improve cash flow.

Key Tools to Consider:

- Just-in-Time Inventory Systems

- AI-Powered Demand Forecasting

5. Short-Term Business Loans: Bridge Cash Flow Gaps

Short-term loans provide immediate access to funds for specific needs, such as purchasing equipment, covering payroll, or funding seasonal operations.

Key Benefits:

- Fast approval processes.

- Customizable repayment terms.

6. Cash Flow Forecasting Tools: Stay Ahead of Financial Needs

Invest in cash flow forecasting software to predict future cash flow needs and make informed decisions. Tools like QuickBooks, Float, and Pulse provide real-time insights to help you plan for growth or mitigate risks.

Key Features to Look For:

- Integration with accounting software.

- Customizable reporting and alerts.

How to Choose the Right Working Capital Solution

Not every working capital solution is suitable for every business. Consider these factors when selecting the best tools and strategies for your organization:

- Business Size and Industry: Tailor solutions to match the specific needs and challenges of your sector.

- Cash Flow Patterns: Analyze your cash inflows and outflows to determine the most pressing needs.

- Growth Goals: Align working capital strategies with your short-term and long-term business objectives.

The Benefits of Optimizing Working Capital

Implementing the right working capital solutions in 2025 can revolutionize your business finances. Here’s what you can achieve:

- Increased Liquidity: Maintain a positive cash flow to cover expenses and fund growth initiatives.

- Reduced Financial Stress: Avoid last-minute scrambling for funds or over-reliance on expensive credit options.

- Competitive Advantage: Stay agile and capitalize on opportunities faster than competitors.

Start Optimizing Your Working Capital Today

With the right tools and strategies, your business can move beyond cash flow constraints and focus on achieving sustainable growth. Whether through invoice financing, cash flow forecasting, or inventory optimization, these solutions ensure your business is prepared for the challenges and opportunities of 2025.

Let’s make this the year your business thrives.

Real-Life Success Stories

Nothing illustrates the value of working capital solutions better than real-life examples of businesses that have turned financial challenges into growth opportunities. By leveraging the right strategies, companies across industries have transformed their cash flow, stabilized their operations, and unlocked their full potential.

These success stories provide actionable insights and inspiration for CFOs, controllers, and business owners looking to achieve similar results.

How Businesses Transformed Their Cash Flow with Working Capital Solutions

1. Scaling a Manufacturing Business with Invoice Financing

A mid-sized manufacturing company faced a cash flow crunch due to extended payment terms from large clients. Their 90-day payment cycles left them struggling to cover raw material costs and payroll. By adopting invoice financing, they unlocked 80% of their accounts receivable upfront, which allowed them to:

- Maintain a steady supply chain.

- Pay employees on time.

- Fulfill larger orders without financial strain.

Result: The company increased production capacity by 25% and secured new contracts with confidence.

2. Growing a Retail Chain with a Business Line of Credit

A regional retail chain experienced seasonal cash flow fluctuations, with high revenue during the holidays but slower periods in the off-season. To bridge these gaps, they implemented a business line of credit, which provided immediate access to funds when needed.

How They Used It:

- Stocking inventory ahead of peak shopping seasons.

- Covering operational costs during slow months.

- Investing in marketing campaigns to boost off-season sales.

Result: Sales grew by 15%, and they expanded into two new locations within a year.

3. Improving Supplier Relationships with Dynamic Discounting

A fast-growing tech company wanted to strengthen relationships with its suppliers while improving its bottom line. By implementing dynamic discounting, they offered early payments in exchange for discounts on bulk orders.

Key Benefits:

- Lower procurement costs by 10%.

- Enhanced supplier loyalty and prioritized order fulfillment.

- Improved cash flow predictability.

Result: The company saved over $200,000 annually and secured exclusive supplier deals.

4. Optimizing Inventory Management for a Food Distributor

A food distribution company struggled with excess inventory, which tied up valuable working capital. Using AI-powered inventory management tools, they analyzed demand patterns and reduced waste by 30%.

Steps Taken:

- Implemented just-in-time inventory systems.

- Adjusted stock levels based on real-time analytics.

- Streamlined order processes to minimize overstock.

Result: Freed up $500,000 in working capital, which was reinvested in fleet expansion to improve delivery efficiency.

5. Stabilizing Cash Flow with Cash Flow Forecasting Tools

A healthcare services provider struggled with inconsistent cash inflows due to delayed insurance reimbursements. By using cash flow forecasting software, they gained real-time insights into their financial position and anticipated shortfalls.

What They Achieved:

- Identified months with potential cash flow issues.

- Secured a short-term loan in advance to avoid disruptions.

- Aligned payment schedules with cash inflows.

Result: Operational disruptions were eliminated, and their financial stability improved, enabling them to expand services.

Key Takeaways from These Success Stories

These businesses achieved remarkable results by addressing their unique cash flow challenges with tailored working capital solutions. Their stories highlight the importance of:

- Choosing the Right Solution: Aligning tools and strategies with specific business needs.

- Taking a Proactive Approach: Anticipating challenges and acting before cash flow issues arise.

- Investing in Technology: Leveraging modern tools for real-time insights and better decision-making.

Your Business Could Be the Next Success Story

The challenges these businesses faced are not uncommon, but their outcomes prove that the right working capital solutions can transform financial struggles into opportunities for growth. Whether you’re navigating seasonal fluctuations, scaling operations, or seeking greater financial stability, there’s a solution tailored to your needs.

The Role of Technology in Cash Flow Optimization

In 2025, technology is no longer a luxury—it’s a necessity for effective cash flow management. Tools powered by artificial intelligence (AI) and automation are transforming the way businesses handle their finances. From predicting future cash flow needs to automating repetitive tasks, technology empowers CFOs, controllers, and business owners to make smarter, faster decisions.

Discover how these innovations can revolutionize your approach to cash flow and position your business for long-term success.

How Technology is Transforming Financial Management

1. AI-Powered Cash Flow Forecasting

Artificial intelligence enables businesses to forecast cash flow with unparalleled accuracy. By analyzing historical data, market trends, and real-time financial metrics, AI-powered tools can predict future cash inflows and outflows.

Key Benefits:

- Anticipate shortfalls and surpluses.

- Plan for investments with confidence.

- Reduce the risk of unexpected financial disruptions.

Example Tools: Float, Jirav, Fathom.

2. Automation for Accounts Payable and Receivable

Manual management of accounts payable and receivable can be time-consuming and prone to errors. Automation tools streamline these processes, ensuring faster payments, fewer mistakes, and better cash flow visibility.

How It Works:

- Automate invoicing and follow-ups for overdue payments.

- Schedule vendor payments to optimize cash flow timing.

- Reduce processing times with digital workflows.

Key Benefits:

- Save time and labor costs.

- Minimize errors in financial transactions.

- Improve relationships with suppliers and customers.

3. Real-Time Financial Dashboards

Gone are the days of relying on static spreadsheets. Real-time financial dashboards provide instant visibility into your cash flow position, helping you make informed decisions on the fly.

Features to Look For:

- Integration with accounting software.

- Customizable dashboards for tailored insights.

- Alerts for critical cash flow thresholds.

Example Tools: QuickBooks Online, Sage Intacct, Xero.

Emerging Technologies to Watch in 2025

1. Blockchain for Financial Transparency

Blockchain technology is revolutionizing financial transactions by providing greater transparency and security. Businesses are using blockchain to streamline payment processing and reduce fraud risks.

Benefits:

- Enhanced trust with suppliers and partners.

- Faster cross-border transactions.

- Secure record-keeping for audit trails.

2. Predictive Analytics

Predictive analytics takes AI to the next level, helping businesses not only forecast cash flow but also identify opportunities for growth and areas of financial risk.

Applications:

- Detect seasonal trends and plan accordingly.

- Identify customer payment patterns for better credit control.

- Pinpoint inefficiencies in financial operations.

How to Implement Technology in Your Cash Flow Strategy

- Start Small: Identify specific pain points in your cash flow management process and choose a tool that addresses them.

- Integrate Seamlessly: Look for tools that integrate with your existing financial systems to avoid disruptions.

- Train Your Team: Ensure employees are equipped to use new tools effectively to maximize ROI.

The Competitive Advantage of Technology in 2025

By embracing AI and automation, businesses gain a significant edge over competitors still relying on outdated processes. Technology enables you to:

- Act Proactively: Anticipate and solve cash flow challenges before they arise.

- Save Time and Resources: Focus on strategic growth initiatives instead of manual financial tasks.

- Enhance Decision-Making: Use data-driven insights to make smarter financial decisions.

Stay Ahead with Technology-Driven Cash Flow Management

The role of technology in cash flow optimization is only growing. By adopting the right tools and strategies, you can streamline your financial operations, improve cash flow predictability, and position your business for long-term growth.

Don’t let outdated methods hold you back—embrace the power of technology and thrive in 2025.