Introduction

In today’s volatile economic climate, CFOs are under immense pressure to maintain financial stability while driving growth. Cash flow disruptions, rising interest rates, and unpredictable supply chains make liquidity management more critical than ever. According to a recent survey, 82% of CFOs say that managing working capital is one of their top priorities in 2024. This blog will provide CFOs with actionable strategies to leverage working capital solutions for greater operational flexibility, enhanced liquidity, and long-term financial success.

Understanding Working Capital Solutions

What Is Working Capital?

Working capital is the difference between a company’s assets and liabilities. It reflects a business’s ability to meet its short-term financial obligations while sustaining operations. Optimizing working capital ensures financial resilience, growth, and the ability to navigate economic downturns.

The Importance of Working Capital Management

Many CFOs overlook the significance of efficient working capital management, but failing to optimize it can lead to liquidity crises, delayed vendor payments, and stalled growth. Proper working capital solutions can:

- Improve cash flow predictability

- Enhance supplier and vendor relationships

- Provide liquidity for unexpected business expenses

- Reduce reliance on high-interest loans

- Enable strategic reinvestment in growth opportunities

Types of Working Capital Solutions CFOs Should Consider

1. Invoice Financing

What it is: Unlocks cash tied up in unpaid invoices by allowing businesses to receive early payments for outstanding receivables.

Key Benefits:

- Immediate cash flow relief

- Reduced reliance on external loans

- Flexibility to manage seasonal demand fluctuations

2. Equipment Financing

What it is: Enables businesses to acquire essential equipment while preserving cash reserves.

Key Benefits:

- Spreads out equipment costs over time

- Keeps operational budgets intact

- Maintains access to cutting-edge technology

3. Supply Chain Financing

What it is: Allows companies to extend supplier payment terms without negatively impacting supplier cash flow.

Key Benefits:

- Strengthens relationships with suppliers

- Improves cash conversion cycle

- Ensures consistent inventory flow

4. Business Credit Lines

What it is: Provides companies with flexible access to capital for covering short-term working capital needs.

Key Benefits:

- Quick access to funds for unforeseen expenses

- Lower interest rates than traditional loans

- Helps businesses maintain liquidity without a debt burden

5. Asset-Based Lending (ABL)

What it is: Uses company assets, such as accounts receivable or inventory, as collateral for working capital loans.

Key Benefits:

- Higher borrowing limits compared to unsecured loans

- Flexible funding based on business needs

- Ideal for businesses with strong asset positions

Why CFOs Should Prioritize Working Capital Solutions

1. Enhancing Liquidity Without Excessive Debt

Rather than resorting to high-interest loans, CFOs can utilize working capital solutions to maintain liquidity. This ensures businesses have access to cash when needed while keeping balance sheets healthy.

2. Managing Economic Uncertainties

With inflation, rising interest rates, and supply chain disruptions, CFOs need financial buffers. Working capital solutions provide the flexibility required to navigate economic downturns and unexpected business expenses.

3. Supporting Strategic Growth Initiatives

CFOs can leverage working capital solutions to fund expansion projects, mergers & acquisitions, and R&D investments without disrupting cash flow.

4. Optimizing Vendor & Supplier Relationships

Strong cash flow enables companies to negotiate better terms with suppliers, take advantage of early payment discounts, and avoid late payment penalties.

5. Ensuring Business Continuity During Market Fluctuations

Having sufficient working capital can help businesses withstand downturns and economic turbulence. CFOs who proactively manage working capital will safeguard their company’s future.

Actionable Steps CFOs Can Take Today

1. Conduct a Working Capital Analysis

- Evaluate current liquidity needs

- Identify bottlenecks in the cash conversion cycle

- Determine optimal financing options

2. Explore Available Financing Options

- Assess financial providers and compare terms

- Select solutions tailored to the company’s financial strategy

3. Leverage Data & Technology

- Utilize AI-driven analytics to forecast cash flow trends

- Implement automated payment and collections tools

4. Build Strong Supplier Relationships

- Negotiate better payment terms

- Leverage supply chain financing where applicable

5. Consult Financial Advisors

- Work with industry experts to design the right working capital strategy

- Regularly review and refine financing structures

Case Studies: Real-Life Impact of Working Capital Solutions

Case Study 1: Medical Equipment Company Improves Cash Flow by 40%

A mid-sized medical equipment provider faced challenges in managing cash flow due to delayed insurance reimbursements. By adopting invoice financing, they unlocked capital tied in unpaid invoices, allowing them to continue operations and expand their services.

Case Study 2: Construction Firm Reduces Debt Burden with Equipment Financing

A construction company leveraged equipment financing to acquire new machinery without depleting cash reserves. This allowed them to take on larger projects while maintaining financial stability.

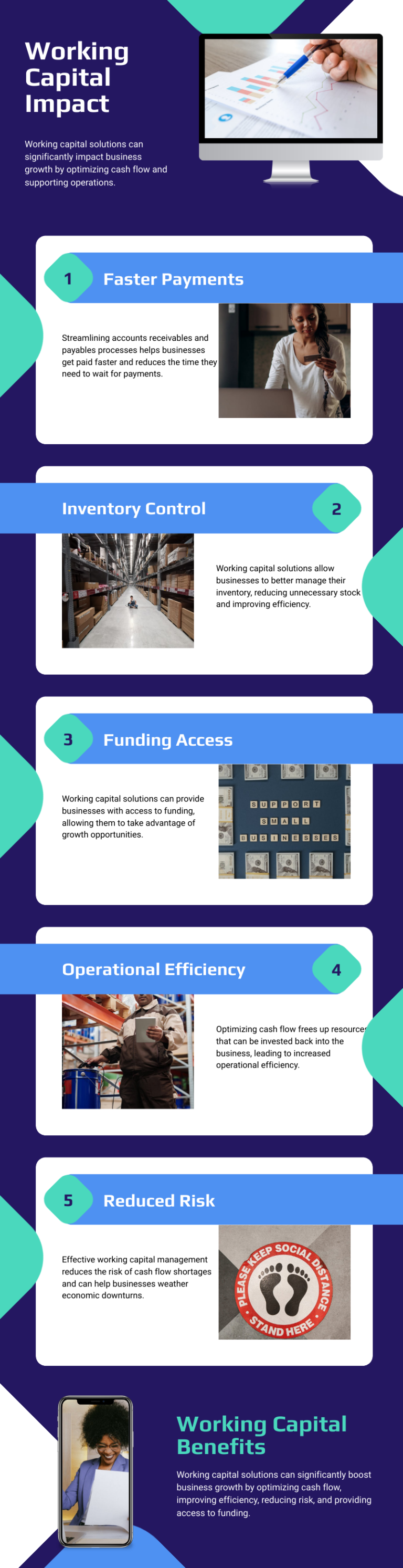

Infographic: The Impact of Working Capital Solutions on Business Growth

Key Benefits:

- Improved cash flow management

- Enhanced vendor relationships

- Increased financial resilience

- Faster access to growth capital

Conclusion

For CFOs navigating today’s financial landscape, working capital solutions are indispensable. By proactively optimizing liquidity, mitigating risk, and strategically managing cash flow, businesses can achieve sustained growth and financial flexibility.

Are you looking for customized working capital solutions for your business? Schedule a free consultation with Lion Tech Finance today and let’s tailor a financial strategy that fits your needs!