CapEx vs. OpEx: Why CFOs Are Shifting AI Infrastructure to OPEX

As AI workloads grow exponentially, purchasing servers and GPU clusters outright ties up significant capital and risks rapid obsolescence. Forward-thinking finance leaders are moving these investments into operating expenses (OpEx) through leasing and Hardware-as-a-Service programs, transforming large, one-time outlays into predictable, flexible payments aligned with usage.

Key Advantages of OpEx-Based AI Funding

-

Predictable Budgeting

Fixed monthly payments replace unpredictable lump-sum investments, making cash forecasting for AI projects straightforward. -

Balance-Sheet Flexibility

True operating leases keep Right-of-Use assets and liabilities off the balance sheet, preserving debt capacity and strengthening leverage ratios. -

Immediate Tax Benefits

Lease payments are fully deductible as operating expenses, accelerating tax savings in the year incurred. -

Hardware Refresh Alignment

Short-term lease cycles (24–36 months) match the pace of GPU and server advancements, ensuring teams always work on cutting-edge infrastructure without stranded assets.

Usage-Aligned Financing Models for GPU Farms and Edge Devices

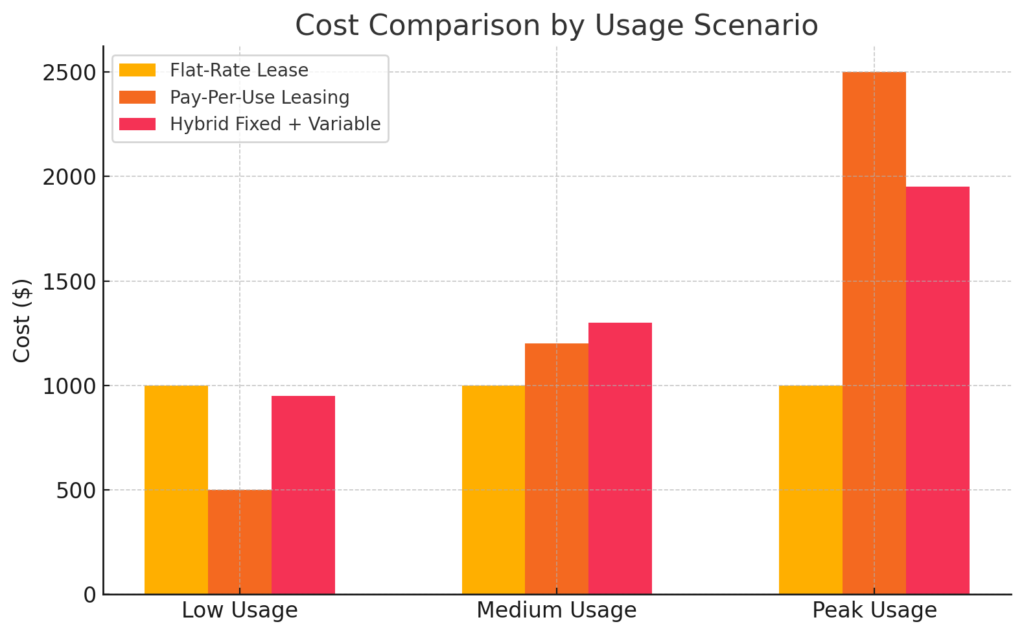

AI workloads are inherently bursty—training runs may spike GPU usage for days, while inference and edge deployments fluctuate with user demand. Traditional flat-rate leases can leave CFOs paying for idle capacity or scrambling for cash when usage surges. Usage-aligned financing models solve this mismatch by tying payments directly to actual consumption and performance requirements.

Pay-Per-Use Leasing

With pay-per-use leases, you only pay for GPU hours and edge-device uptime you consume. During intensive training phases, payments rise to cover peak demand; when models enter maintenance or inference mode, costs automatically scale down. This structure:

-

Eliminates Waste: No more over-budgeting for worst-case scenarios

-

Improves Forecasting: Costs track with real-time usage trends

-

Supports Experimentation: Teams can spin up large clusters for short bursts without long-term commitments

Hybrid Fixed-Plus-Variable Structures

For predictable baseline workloads with occasional spikes, hybrid financing blends a smaller fixed monthly payment (covering core infrastructure) with variable usage fees for burst capacity. Key benefits include:

-

Cash Stability: A known floor payment anchors budgets

-

Scalable Growth: Variable portion scales with project needs

-

Balanced Risk: CFOs avoid paying full CapEx while retaining capacity for unexpected demands

By adopting usage-aligned financing, finance leaders ensure their AI infrastructure financing mirrors actual consumption, maximizing cost efficiency and empowering data science teams to innovate without financial friction.

Structuring 100% Equipment Leases for High-Performance Compute Clusters

Rather than purchasing any portion, leasing your entire GPU cluster lets you preserve working capital for strategic initiatives. To structure a true “100% lease,” you’ll need to:

-

Define Your Asset Scope:

Pinpoint exactly which servers, GPUs, storage arrays, and networking gear you need. Group them into a single lease schedule to simplify paperwork and maximize bundle discounts. -

Choose the Right Term:

Match lease duration to hardware lifecycles, typically 24 to 36 months for AI compute, so that you can swap to next-gen architectures without penalties. -

Negotiate Payment Profiles:

-

Level Payments: Equal installments for straightforward budgeting.

-

Step-Up/Step-Down: Lower payments during pilot phases, higher during production runs.

-

Deferred First Payment: Delay the first month until after initial model validation.

-

-

Structure End-of-Term Options:

Ensure your lease includes flexible lease-end choices:-

Fair Market Value Purchase: Buy the equipment at the current market price.

-

Return & Refresh: Send back old hardware and roll into a new lease.

-

$1 Buyout: Own the assets for a nominal fee at term’s end.

-

-

Protect with Vendor Partnerships:

Leverage vendor financing programs (e.g., direct through your hardware supplier) to streamline approvals and often secure better residual values.

Aligning Lease Terms to AI Workload Cycles

To maximize value, tie your lease parameters directly to your compute demands:

-

Pilot Phase: Use a short deferral or reduced-payment period while you benchmark model performance.

-

Scale-Up Runs: Structure a step-up payment during heavy training months.

-

Maintenance: Include a “pause” or step-down option for inference-only periods, lowering your costs when peak power isn’t needed.

By carefully crafting each element, term length, payment profile, end-of-term option, and vendor alignment, you’ll fund your high-performance infrastructure with zero upfront cash, ensuring your AI teams stay on the cutting edge.

Tax & Accounting Impacts: Navigating ASC 842/IFRS 16 for AI Hardware

Leasing AI servers and GPU clusters isn’t just a cash-flow decision—it carries significant tax and balance-sheet implications under the new lease accounting standards. ASC 842 (U.S. GAAP) and IFRS 16 require most leases to be recorded as right-of-use (ROU) assets and corresponding lease liabilities, impacting leverage ratios, EBITDA, and debt covenants.

Key Considerations, Lease Classification, Balance-Sheet Treatment

-

Right-of-Use Asset & Liability Recognition

Under both standards, a lessee must record an ROU asset and a lease liability at the present value of future lease payments. For high-performance compute clusters, this means immediate expansion of lease obligations on Day 1. -

Operating vs. Finance Lease Classification

Distinguish operating leases (no transfer of ownership, low residual guarantees, term <75% of asset life) from finance leases (effectively a purchase). Proper structuring—shorter terms, minimal buyout options—can preserve operating-lease treatment and prevent liability inflation. -

Impact on Financial Metrics

-

EBITDA: Lease payments shift partially from expense to depreciation and interest, potentially boosting EBITDA.

-

Leverage Ratios: ROU liabilities increase total debt, so covenant headroom must be reevaluated.

-

Asset Turnover: Adding ROU assets can dilute turnover ratios unless paired with revenue uplifts from faster AI deployment.

-

-

Tax Deductibility & Cash Timing

Lease payments are typically fully deductible as operating expenses, accelerating tax benefits compared to capitalized asset depreciation schedules. This immediate write-off preserves after-tax cash flow. -

Disclosure & Reporting

Maintain a detailed lease register and provide transparent footnote disclosures, including lease terms, discount rates, and maturity profiles, to satisfy audit and investor expectations.

By mastering ASC 842 and IFRS 16 nuances, classifying leases correctly, optimizing terms, and planning for ROU impacts, CFOs can leverage AI hardware financing without unforeseen hits to their balance sheet or covenant compliance.

Measuring ROI: Key Metrics for AI Compute Financing

Investing in AI infrastructure, whether via purchase, lease, or financing—demands rigorous measurement of both financial returns and operational impact. CFOs should focus on a concise set of metrics that tie compute costs directly to business value, enabling data-driven capacity planning and capital allocation.

Total Cost of Ownership (TCO) & Cost per Usage

Calculate TCO by summing all costs over the asset’s useful life: acquisition or financing fees, power & cooling, maintenance, software licenses, and support. Divide this total by actual compute hours or workload units (e.g., GPU-hours, vCPU-hours) to derive the cost per usage. This apples-to-apples metric lets you compare on-premises, co-location, and cloud-based options consistently.

Utilization Rate & Productivity Impact

Monitor average and peak utilization of your GPU/CPU fleet. Higher utilization spreads fixed costs over more productive hours, reducing unit costs. Pair utilization metrics with operational KPIs, such as model-training turnaround time or inference latency, to quantify productivity gains from faster AI pipelines.

Payback Period & Cash-on-Cash Return

Estimate the payback period by dividing the initial cash outlay (or cumulative lease payments) by net annual benefits, including cost savings or incremental revenue. Complement this with cash-on-cash return: annual pre-tax cash flow divided by initial investment, providing a clear view of how quickly financed outlays convert into free cash.

Net Present Value (NPV) & Internal Rate of Return (IRR)

Build a discounted-cash-flow model that projects incremental cash flows from AI initiatives, labor efficiency, reduced error rates, or new AI-driven revenue, against capital and operating costs. NPV reveals the project’s value in today’s dollars; IRR identifies the discount rate at which the investment breaks even, guiding hurdle-rate thresholds.

Performance Efficiency & Cost per Inference

Beyond raw throughput, assess cost per inference (or per training epoch) by dividing total compute spend by the number of model predictions or training cycles completed. Tracking this metric over time highlights gains from hardware upgrades, software optimizations, or workload consolidation that directly boost ROI.

Scalability & Future-Proofing Considerations

Evaluate financing structures that offer elasticity, such as seasonal leases or pay-as-you-go cloud contracts, to match payments with usage patterns. Flexibility to scale capacity up for peak workloads and down during lulls preserves cash, minimizes idle spend, and safeguards ROI as AI demand fluctuates.

Dashboarding & Reporting

Consolidate these metrics into a rolling dashboard, TCO, utilization, payback, NPV/IRR, cost per inference, and budget variances. Schedule regular reviews against forecasts and strategic targets to catch deviations early, inform procurement or financing adjustments, and ensure every dollar in AI compute drives maximum business value.

Vendor-Direct Financing: Seamless Procurement Through Strategic Partnerships

Working directly with hardware vendors or OEMs streamlines AI hardware procurement by bundling financing, deployment, and support into a single strategic agreement. CFOs can leverage vendor relationships to secure tailored payment terms, volume discounts, and value-added services, reducing complexity, accelerating time to value, and protecting cash flow.

Partnership Structures & Direct Terms

Common structures include capital leases, vendor financing agreements, and equipment loan arrangements. CFOs should evaluate fixed payment plans, flexible payment schedules, and performance-based incentives to match cash flow profiles. Negotiated elements such as deferred initial payments, volume rebates, and bundled maintenance can lower upfront costs and enhance total ROI.

Negotiation Strategies & Incentive Alignment

Start by sharing multi-year demand forecasts and volume commitments to unlock preferential pricing. Seek discounts tied to utilization thresholds, adoption milestones, and early signing. Build in vendor incentives like training credits, spare-parts waivers, and co-marketing support to capture value beyond hardware alone.

Integration, Scalability & Vendor Support

Ensure agreements include installation services, integration assistance, and ongoing support service-level agreements. Flexible scale-up options, capacity add-on clauses, or software upgrade paths let you match growth with technical needs. Regular performance reviews and joint planning sessions help optimize utilization and limit idle spend.

Compliance, Reporting & Risk Mitigation

Embed clear audit clauses, reporting requirements, and vendor risk assessments into contracts. Specify data security standards, warranty protection, and end-of-term buyout or return conditions. Transparent term sheets and periodic reconciliations guard against hidden costs and regulatory exposures.

Scalable Funding Strategies for Burst-Capacity and Peak Workloads

Handling unpredictable AI workload spikes requires financing models that flex with usage. CFOs can adopt tiered commitments, credit buffers, and pay-per-use contracts to align spending with demand, ensuring capacity when needed, and controlling costs when idle.

Tiered Commitments, Credit Buffers & Flex Lines

Structure agreements with graduated capacity tiers, standby credit facilities, and flexible payment cushions, CFOs secure priority access to additional compute at predictable rates, maintain headroom for sudden surges, and avoid lengthy approval cycles.

Pay Per Use & Consumption Billing

Leverage consumption-based billing from cloud and managed service providers, CFOs convert fixed costs into variable costs, pay only for actual compute consumed, and align spend directly with workload intensity and duration.

Reserved Capacity Pools & Burst Credits

Negotiate reserved capacity pools or burst credit allocations with vendors and cloud partners. CFOs lock in discounted baseline capacity while retaining rights to temporary boosts at agreed incremental rates.

Hybrid Funding Models & Cost Arbitrage

Combine on-premises infrastructure, co-location commitments, and cloud credits, CFOs optimize total cost through channel arbitrage, shifting workloads to the most cost-effective environment based on pricing, performance, and funding terms.

Continuous Monitoring, Alerts & Cost Governance

Deploy finance dashboards with real-time utilization metrics, spend tracking, and budget variance alerts. CFOs trigger timely reviews, enforce cost guardrails, and adjust funding lines proactively as demand patterns evolve.

Risk Mitigation: Preserving Balance Sheet Headroom with Synthetic Leases

Leveraging synthetic leases allows CFOs to access AI hardware capacity without inflating on-balance sheet liabilities, safeguarding debt covenants, and leverage ratios. By structuring agreements that meet operating lease criteria while delivering full use rights, finance leaders can optimize capital efficiency and protect borrowing capacity.

Lease Structure Options, Off-Balance Sheet Treatment

Under a synthetic lease, the lessor holds legal title while the lessee retains beneficial use, keeping both the asset and related liability off the balance sheet. Key design elements include no bargain-purchase options, residual value guarantees held by the lessor, and service components bundled to meet operating lease definitions.

Impact on Leverage Ratios, Covenant Preservation

Since payments flow through the income statement as operating expenses, synthetic leases avoid creating right-of-use assets and lease liabilities. This treatment maintains lower total debt, preserves EBITDA-to-debt ratios, and keeps compliance headroom for bank covenants during periods of rapid AI infrastructure expansion.

Accounting Compliance, Regulatory Disclosure

With ASC 842 and IFRS 16, many traditional synthetic leases now trigger balance-sheet recognition unless properly structured. Collaborate with legal and accounting teams to ensure terms, lease duration, residual risk allocation, and service elements align with “true lease” criteria, and prepare transparent footnote disclosures to satisfy auditors and investors.

Flexibility, Exit, and Buyout Strategies

Negotiate term lengths, maintenance obligations, and end-of-term options, such as fair-market purchase rights or return provisions, to manage asset risk and residual value exposure. Embedding early-termination clauses and performance reviews ensures you can adapt capacity commitments as technology needs evolve, minimizing stranded-asset risk.

Integrating Hardware As A Service into Your Enterprise Tech Stack

Adopting Hardware As A Service (HaaS) transforms capital outlays into operating expenses while embedding AI compute directly into existing IT workflows. CFOs and technology leaders should align on platform capabilities, security requirements, management tools, and financial controls to ensure seamless integration, optimized utilization, and predictable budgeting.

Platform Selection, Vendor Certification & Service Level Agreements

Choose HaaS platforms that offer pre-qualified hardware profiles, certified integrations with your virtualization or container environments, and clear service-level agreements. Evaluate uptime guarantees, support response time, and upgrade pathways to match your performance needs and risk tolerance.

Network, Security & Identity Integration

Ensure HaaS nodes connect securely to your enterprise network via VPN or private connectivity, with consistent firewall policies and zero-trust controls. Integrate with your identity provider for single sign-on and role-based access, enforcing encryption in transit and at rest to meet compliance mandates.

Monitoring, Management & Automation

Incorporate HaaS telemetry into your centralized IT operations dashboard for real-time health checks, capacity alerts, and anomaly detection. Leverage infrastructure as code and orchestration tools to provision additional hardware on demand, automate firmware updates, and enforce configuration drift prevention.

Cost Allocation, Chargeback & Financial Governance

Map HaaS usage back to business units or projects through tagging and metering, enabling accurate chargeback or showback processes. Define budget thresholds and automated alerts for overspend, and review monthly usage reports to forecast commitments, negotiate rate adjustments, and optimize resource planning.

Future-Proofing AI Investments, Flexibility & Upgrade Path Financing

AI hardware evolves at breakneck speed, and CFOs must guard against obsolescence while maintaining budget discipline. By embedding flexible upgrade paths, modular financing structures, and lifecycle planning into procurement agreements, finance leaders can ensure capacity scales with innovation without stranding capital in outdated assets.

Modular Contracts, Technology Refresh Schedules & Renewal Options

Negotiate contracts that include scheduled refresh cycles, typically every 12 to 24 months, with built-in upgrade credits. Renewal options should lock in pricing protection while allowing you to expand capacity or swap in next-gen GPUs as performance demands grow.

Cross Vendor Compatibility, Interoperability & Standardization

Specify open standards, API compatibility, and interoperability clauses to avoid vendor lock-in. Multi-vendor frameworks let you mix and match hardware profiles, ensuring new components slot seamlessly into your existing compute fabric.

Finance Structures, Upgrade Credits & Trade-In Programs

Work with vendors to include upgrade credits or trade-in allowances as part of your financing package. Structured financing spreads incremental upgrade costs over the asset lifecycle, and trade-in programs offset new acquisition expenses by applying value from retired hardware.

Lifecycle Planning, Depreciation & Residual Value Management

Align accounting depreciation schedules with your refresh roadmap to maximize tax benefits. Forecast residual values based on market trends and negotiate guaranteed buy-back or residual value guarantees to minimize write-off risk at end-of-term.

Continuous Assessment, Roadmap Alignment & Budget Forecasting

Implement quarterly reviews of technology performance, vendor roadmaps, and market price curves. Tie financing tranches to milestone-based releases and incorporate these insights into rolling budget forecasts, keeping your AI investment plan agile, cost-effective, and always aligned with strategic objectives.